What is happening now

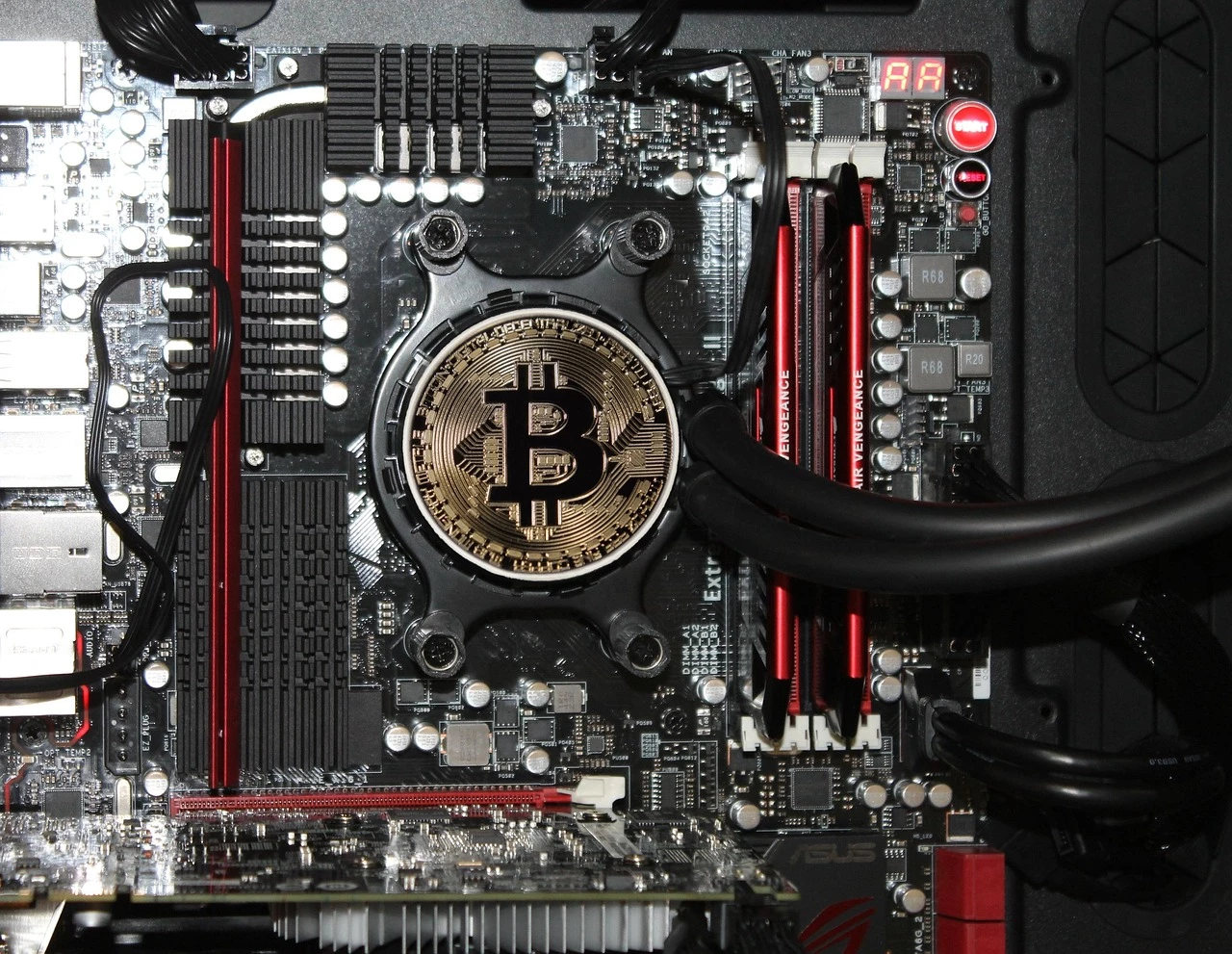

In January 2026, Bitcoin mining shows notable growth as network difficulty adjusts for the first time this year. Despite recent price fluctuations, miners are increasingly active, with hash rates climbing steadily. This uptick follows a minor dip in mining difficulty earlier this month, which encouraged more mining participation across the globe.

Additionally, Bitcoin’s price has experienced volatility, hovering around mid-$30,000s to $40,000s, prompting both short-term traders and miners to reassess their strategies. The combined effect has stirred renewed interest in Bitcoin as a digital asset and in the infrastructure supporting its ecosystem.

Why it matters

Mining activity is a key indicator of Bitcoin’s health and network security. Increased participation means higher hash rates, which strengthen resistance to attacks and enhance transaction confirmation speeds. This supports the confidence of investors and users in the Bitcoin network.

Moreover, shifts in mining difficulty adjust the effort required to add new blocks, influencing miners’ profitability. When difficulty decreases, mining becomes relatively easier, potentially leading to higher mining rewards. This can attract more miners, which is vital for decentralization and security. Conversely, if difficulty rises too much, less efficient miners might exit the market.

Key risks

Bitcoin’s price volatility remains a significant risk factor that can impact miners’ earnings and investment decisions. Sudden downturns could cause some miners to pause operations, leading to a temporary drop in network security.

Additionally, regulatory changes worldwide present uncertainties. New rules affecting mining operations or cryptocurrency trading in key regions might disrupt market dynamics and miner participation.

Energy costs and supply chain challenges for mining hardware could also affect the sector, especially if these costs rise sharply.

What to watch next

Watch for the next Bitcoin mining difficulty adjustment expected later this month, which will reveal the sustainability of the recent activity increase. Also, monitor Bitcoin’s price movements closely, as sustained gains or losses can influence mining and trading behaviors.

Keep an eye on announcements from major mining firms and changes in global energy policies that could impact operations. Lastly, regulatory developments in large markets such as the US or Europe will be crucial for understanding future mining and investment conditions.

Quick FAQ

1. Why does Bitcoin mining difficulty change?

Bitcoin mining difficulty adjusts every 2,016 blocks (roughly every two weeks) to maintain a consistent block creation time of about 10 minutes. If more miners join, difficulty increases; if miners leave, it decreases.

2. How does mining activity influence Bitcoin’s price?

While mining itself does not directly set Bitcoin’s price, higher mining activity can boost network security and investor confidence, potentially positively affecting price. However, price fluctuates mainly due to market demand and external factors.

3. What should new investors consider with current mining trends?

New investors should watch how mining difficulty and network hash rates evolve, as these reflect Bitcoin’s security and network health. It’s also important to understand that mining profitability depends on price, electricity costs, and hardware efficiency.